I’d like to spend this week’s newsletter raking over the Sam Bankman-Fried trial, but I’m not going to. It’s a seminal moment for crypto, and it’s absolutely fascinating. But I’ve got something more important to discuss.

If you’re interested or invested in crypto, get a copy of Number Go Up, by Zeke Faux, and read it. In this book you will find the essence of the crypto-scepticism that will be one of the main public takeaways from the SBF trial.

To sign up to this newsletter, enter your email, tick the box and click subscribe!

The book, unlike the trial, provides a way to calmly evaluate the crypto critique free from the complications of determining guilt. Faux, an investigative financial journalist for Bloomberg, has written the book that will make his name. To me, it’s a masterpiece, even though I think Faux’s central argument is wrong.

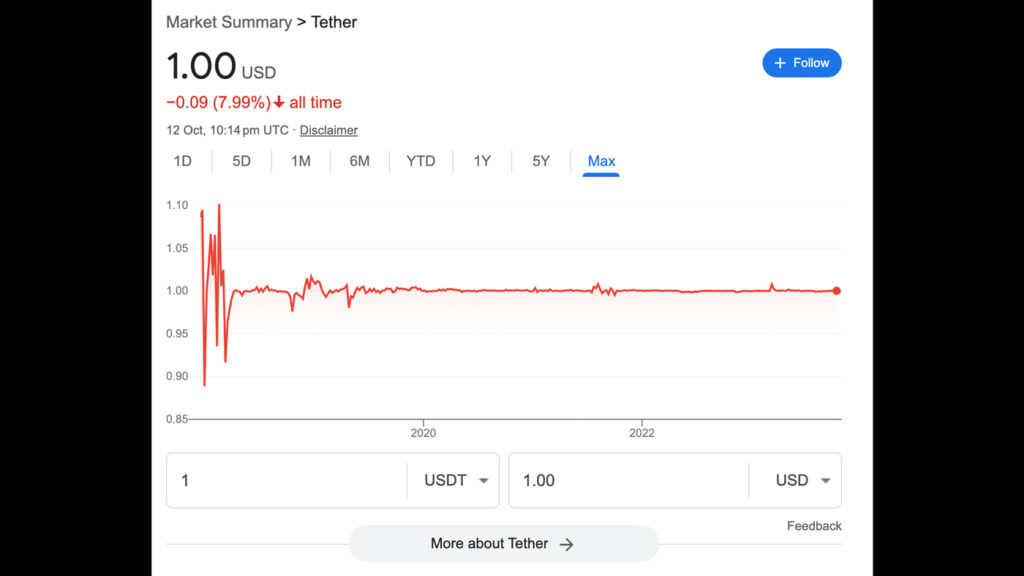

In the book, Faux sets out to expose Tether, a cryptocurrency tied to the value of the US dollar (1 Tether = 1 dollar, see market graph below). Faux demonstrates in the book that Tether is widely used to facilitate crime – money laundering and scamming – and claims it is responsible for human trafficking.

Tether’s claim on being a “stablecoin”, and the basis of its utility, rests on having 1:1 dollar cash reserves. Faux investigates these reserves, on the strong suspicion they don’t exist, but comes up short.

The Tether investigation is the main thread in the book, from which Faux branches off to interview Sam Bankman-Fried (twice, including after the collapse of FTX), delve into the Axie Infinity bubble, and buy a Mutant Ape Yacht Club NFT.

It’s a pretty astounding achievement in terms of an investigation, conducted over two years, with more than 300 interviews and many international trips. Through it, Faux appears as a straight-shooting if slightly gonzo journalist, who calls bullshit when he sees it. And there’s plenty to see.

An endearing trait that strengthens the book is Faux’s tendency to admit his own weaknesses and mistakes. For example, he swallows Bankman-Fried’s schtick in the first interview, not questioning the financial underpinnings of the now-collapsed FTX business when he had the opportunity.

Faux on Axie

The chapter on Axie Infinity is particularly relevant to readers of this newsletter. For anyone who has investigated BG it serves as an indicator of the problems with Faux’s main thesis.

Axie is the blockchain game that blew up in 2021 when users – chiefly in the Philippines and other parts of SE Asia – discovered they could earn decent money playing and “breeding” the game animals, Axies, which are NFTs. The game itself is simple and all the attraction was in the ability to earn money. Playing required users to buy a starting set of Axie NFTs. This classic pyramid set up collapsed in due course.

“The daily rate of return was 8 percent – way, way too good to be true. At that rate, with daily earnings continually reinvested for ten months, [everyone] who bought a single set of Axies would be trillionaires.”

The craze lasted for a few months, and many already-poor people lost big sums on Axies which became worthless overnight when the bubble burst. Faux visits some of these unfortunate people, many of whom are holding on to their Axies, forlornly waiting for value to return. For Faux, the game is just another example of a crypto Ponzi scheme.

While the Axie bubble showed what’s wrong with “play-to-earn”, what Faux ignores is the many blockchain games in development that don’t share that approach. The games we care about at Polemos use blockchain tech to extend game worlds beyond the immediate game environment, for example allowing gamers to trade game assets on open markets. Faux has omitted any mention of these developments.

What is and what could be

The biggest problem for me with Faux’s narrative is his limited view of the possibilities of the technology. Faux points out in devastating style the superficiality, greed, hot air, and exaggeration of crypto. Many of the same criticisms could be levelled at the entire financial world.

He is dismissive of blockchain technology, pointing out that Bitcoin is useless as a working currency, and that Tether has been enthusiastically embraced by criminals. He derides the blockchain as simply a distributed database, and implicitly criticises it as unreal.

“The fundamental absurdity of all this is that the numbers in the Bitcoin blockchain don’t represent dollars, or even have any inherent tie to the financial system at all. There’s no reason why a Bitcoin should be worth more than … any other number in any other database.”

It’s Faux who is missing the point here. There is no inherent reality in dollars either. Dollars only have value because people act as though they have value, and “the financial system” is just an elaborate series of closed databases.

Finance – like nationality, religion and law – is a classic case of an “intersubjective reality” (see Yuval Noah Harari). The entire shebang rests on the adoption of imaginative invention as reality. Crypto is right at home among the other useful illusions of finance.

While I agree with Faux that currently crypto hasn’t lived up to the hype, I think blockchain technology, and ideas springing from the world of crypto will rise to take an important role in the web of intersubjective reality that is the modern world.

Some other points:

- The idea of the distributed database is actually not a trivial one, despite what Faux says.

- I agree with Faux that the user experience in crypto is horrible and not ready for the mainstream.

- But technologies are often flawed when they first emerge. The first cars were expensive, noisy, and inconvenient in a world set up for horse and cart.

- A question not explicitly dealt with in the book: Is the prevalence of scams, fraud and other bad actors inherent to decentralised systems? Why?

While there are many flaws in crypto, and the blockchain is still finding its feet, we may see in-game assets as the first mainstream blockchain application not tied to speculation. That would be a big step to widespread adoption. Number Go Up shows that, as always with journalism, it’s easier to point out flaws and problems than to identify the birth of something new.

So why read it?

If you are working in crypto, you need to engage with the case against crypto. After reading Faux’s book, you’ll understand this is a significant challenge. His investigation is marked by a journey from the ridiculous to the sinister, and depite his failure to nail Tether, it’s powerful.

This is the online version of the Polemos weekly newsletter. Sign up!